In preparation for the future launch of Tontines in the UK & Europe, we have signed up for the FCA endorsed scheme

Mar 21, 2022

01:52 min read

Tontine Trust joins UK Pension Transfers Initiative

Dean McClelland

Full Press Release from Criterion here:

Tontine Trust joins STAR | 03 DECEMBER 2020 | Pan-European pensions and CDC platform Tontine Trust joins the STAR Transfers & Re-Registration Initiative

The STAR initiative, created as a collaboration between Criterion and TeX, is the only cross-industry solution that brings together platforms, ISA managers, pension companies, asset managers and transfer agents to put in place service level agreements that facilitate quick, efficient and predictable pension transfers and re-registration.

Irish “Retiretech” Tontine Trust has now joined the initiative. Tontine Trust is an award-winning fintech/fiduciary organisation that is building a platform for issuing and operating tontine-style Pan-European Personal Pensions (PEPPs) and Collective Defined Contribution (CDC) pension schemes. Backed by Enterprise Ireland, the firm employs 20 people and is already setting new standards for pension excellence amongst savers by using state-of-the art technology to enable simple, safe, low-fee lifetime income solutions.

Richard Kent, Head of Governance at TontineTrust, commented:

"We are delighted to support the STAR initiative, which demonstrates our commitment to consumers and industry stakeholders. Not only will it be a vehicle to showcase performance, but will also reduce complaints, queries, referrals and additional work, which will assist in eliminating levels of additional administration and associated costs."

Dean McClelland, Tontine Trust’s founder, added:

“In the past, the way incumbents retained customers was to make it too much trouble for them to leave. In the digital world, you focus on consumer needs and enable them to judge your product on its own merits. The sign of a great digital product provider is that they make it easy to leave but then double-down on improving their product and consumer experience so that you will never actually want to. Our philosophy is to offer the ‘perfect’ pension product at a very low cost and then to work continuously to make it better and better. Making it easy for consumers to move to or from our platform is part of our duty to members of our schemes. It’s also good business sense”.

Andrew Marker, Chair of the STAR Steering Group and Head of Retail Pension, Vanguard Asset Management Limited said:

“We are delighted that Tontine Trust has shown their support for STAR which continues to grow. The initiative has galvanised the industry to create long-term solutions to improve the customer experience of transferring pensions, savings and investments between companies, by setting transfer targets, measuring each firm’s performance against a good practice framework, accrediting firms and publishing results.

“STAR aims to become the single, authoritative source of transfer data on how firms are performing. It will publish a quarterly industry index to help industry participants benchmark their own performance and provide transparency for consumers. This will work hand-in-hand with an annual accreditation scheme of bronze, silver and gold, so that performance can be evidenced, rewarded and improvements encouraged.”

During September, platforms – Aegon, Fidelity, Hargreaves Lansdown and Standard Life – contacted their fund groups requesting they support the STAR Transfers & Re-Registration initiative.

For further information please contact Rob Kingsbury Director KGR Media Services Limited 07900 931 305 robkingsbury@kgrms.co.uk

Matt Dransfield Commercial and Marketing Director Criterion 0773 765 0010 matthew.dransfield@criterion.org.uk

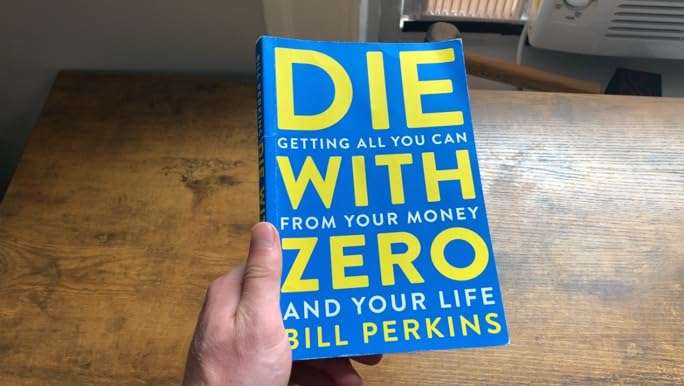

Book Review: Die with Zero by Bill Perkins

The aim of the book is to help you shift focus from maximizing wealth to maximizing life experiences.

What Is a Tontine? Should You Invest In One?

Ruth Saldanha asks: Is a Tontine the Best Way to Get Income in Retirement?

Opinion: DoL must regulate IRA accounts

Kerry Pechter, author of Annuities for Dummies & editor of the RIJ explains why new rules on annuities are needed