by Richard K. Fullmer & CFA Institute Research Foundation

May 4, 2019

Tontines: A Practitioner's Guide to Mortality-Pooled Investments

FOREWORD:

My introduction to tontine thinking came in 2007 in the form of Ralph Goldsticker’s Financial Analysts Journal article “A Mutual Fund to Yield Annuity-Like Benefits.” I had previously heard of the tontine concept but never really thought about it in depth. The article piqued my intellectual curiosity as the idea—and all its potential variations—began to sink in. Tontines became a hobby over the next few years. Scholarly materials on the subject seemed surprisingly scarce at the time, and it occurred to me that although tontines were a centuries-old product, modern tontine thinking was still in its infancy—a new frontier that had so far been explored only at its edges.

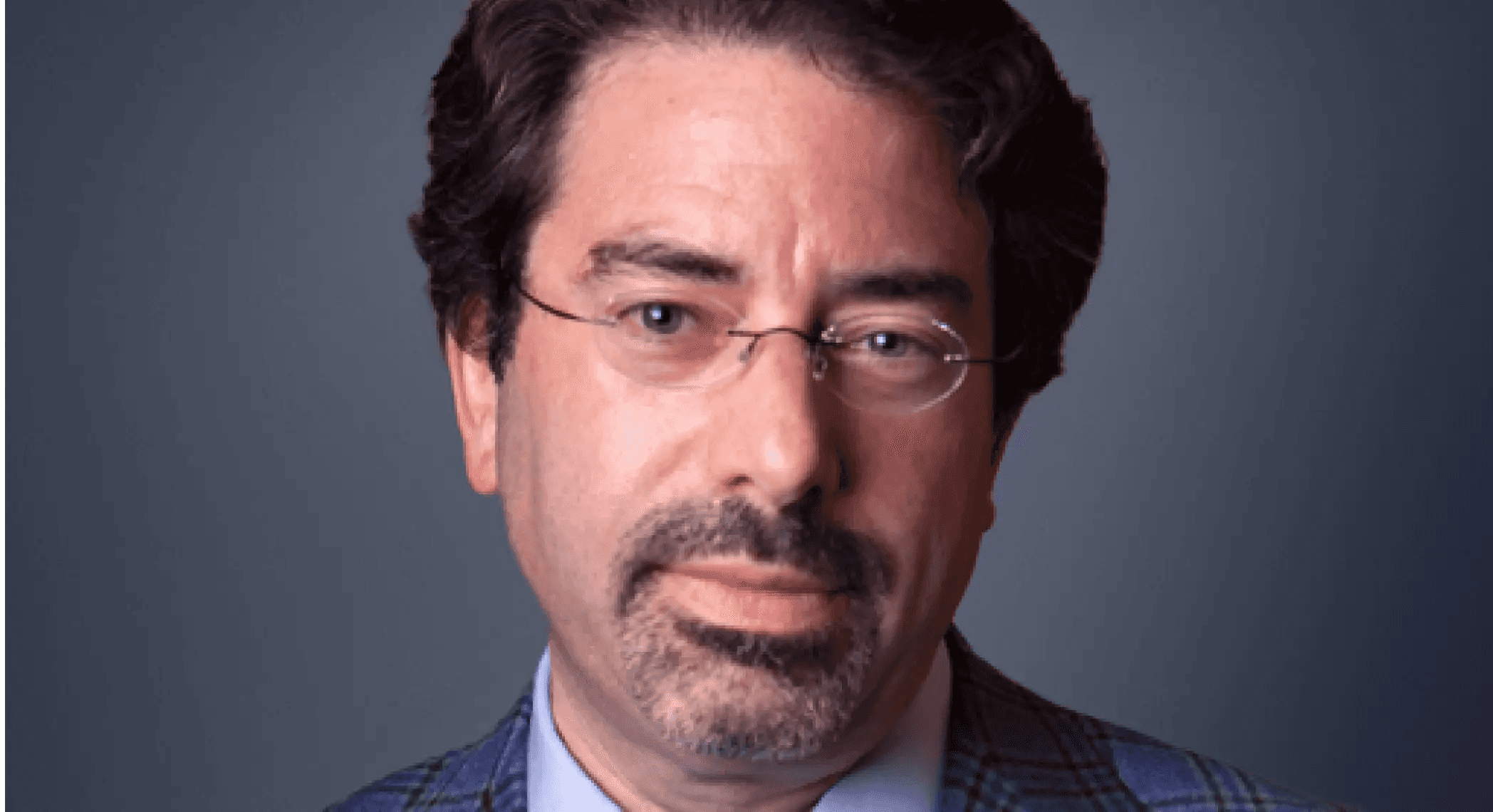

To my good fortune, Moshe Milevsky emerged as a leading expert on the subject and was kind enough to chat with me about the subject whenever our paths crossed. Milevsky introduced me to Michael Sabin, with whom I have since enjoyed a close collaboration in the study of tontines. Sabin introduced me to Jonathan Forman, a professor of law and fellow tontine researcher. I have learned much from these pioneers of modern tontine thinking.

The idea for this brief came from a conversation with Larry Siegel, CFA Institute Research Foundation Gary P. Brinson Director of Research. While chatting about other topics, the conversation eventually turned to my work on fair tontine design, which, in turn, led to a conversation about the potential benefit of producing an introductory practitioner’s guide on the subject. The timing seemed right for three reasons. First, interest in the potential of tontines and tontine-like solutions is picking up, spurred by the so-called global retirement crisis. Second, the products are widely misperceived and poorly understood. Third, practitioner curricula on the topic, whether investment or actuarial, are scarce if they exist at all. So, there was both a reason and a need.

Mortality-pooled investing, such as with tontines, requires a bit of a paradigm shift relative to traditional investing. Although this brief is far from a complete handbook on the subject, it aims to serve as a practitioner’s basic introduction.

If most of what you know about tontines came from a fictional novel, a film, a newspaper article...